Let's get you funded! Eva is on it!

We're building an AI-powered commercial lending marketplace that screens & matches business borrower credit applications with commercial lending financial institutions.

Eva, your industry-trained AI Agent, provides a base risk score & report for every credit application—automatically, using data from 10+ external APIs.

Traditional credit origination is slow, manual, and fragmented

EVA automates, secures, and streamlines the process with AI, blockchain, and modern UX.

"EVA revolutionizes how financial institutions handle credit origination, enabling them to make faster, more accurate decisions while enhancing security and compliance."

Key Features

A comprehensive platform designed for every participant in the credit origination lifecycle

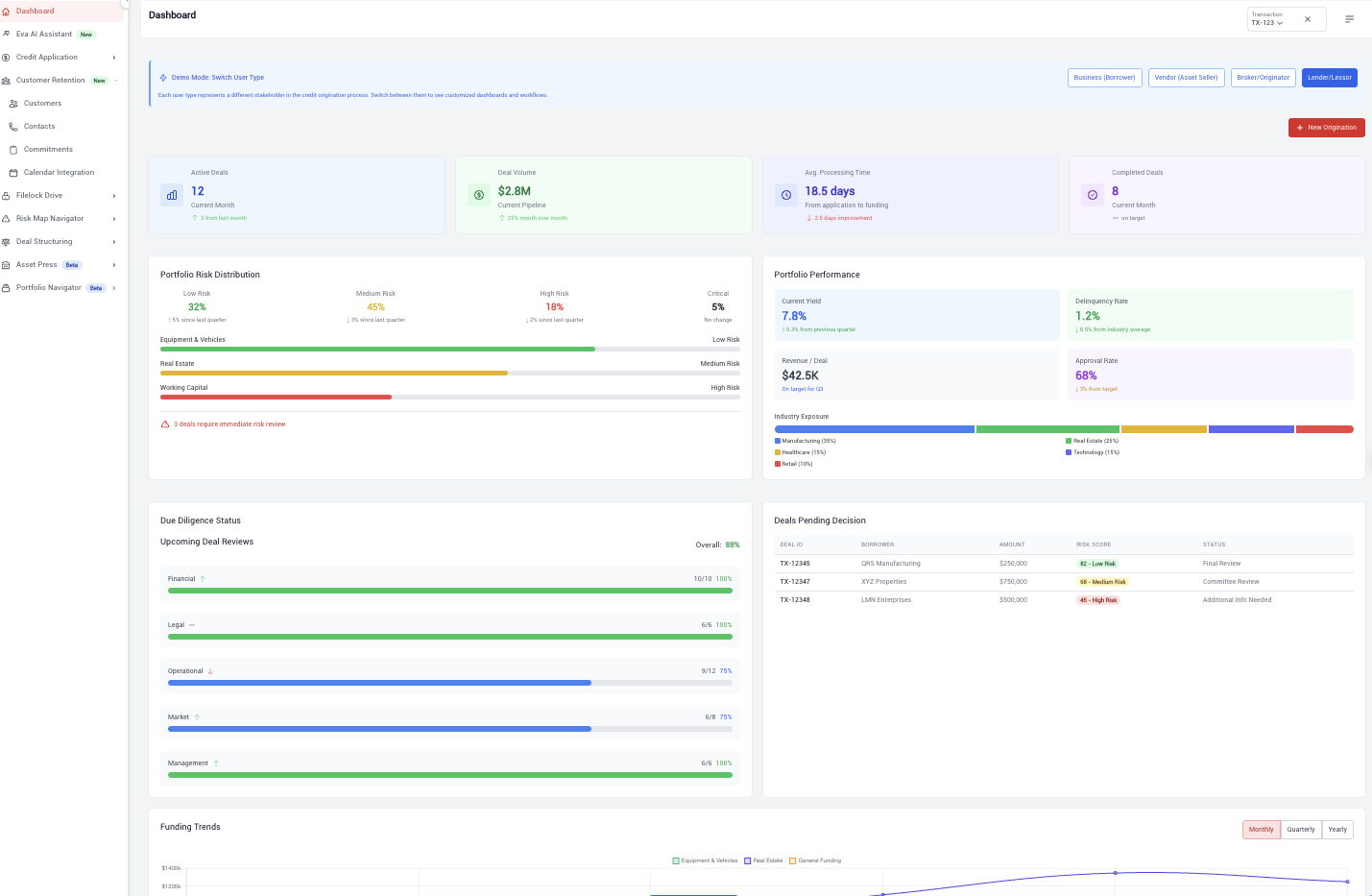

Dashboard

Role-specific, personalized views for all stakeholders in the credit origination process.

Credit Application

Multi-stage, secure, AI-verified applications with digital signatures and pre-fill capabilities.

Customer Retention

Contact management, commitment tracking, analytics, and calendar integration.

Risk Assessment

ModularRiskNavigator, AI risk scoring, compliance tools, and detailed metrics.

Deal Structuring

Covenant management, AI term sheet generation, and pricing optimization.

Transaction Execution

E-signature, document workflow management, and closing checklists.

Filelock Drive

Blockchain-secure storage, versioning, and comprehensive audit trails.

Safe Forms

AI-enhanced document generation with built-in compliance templates.

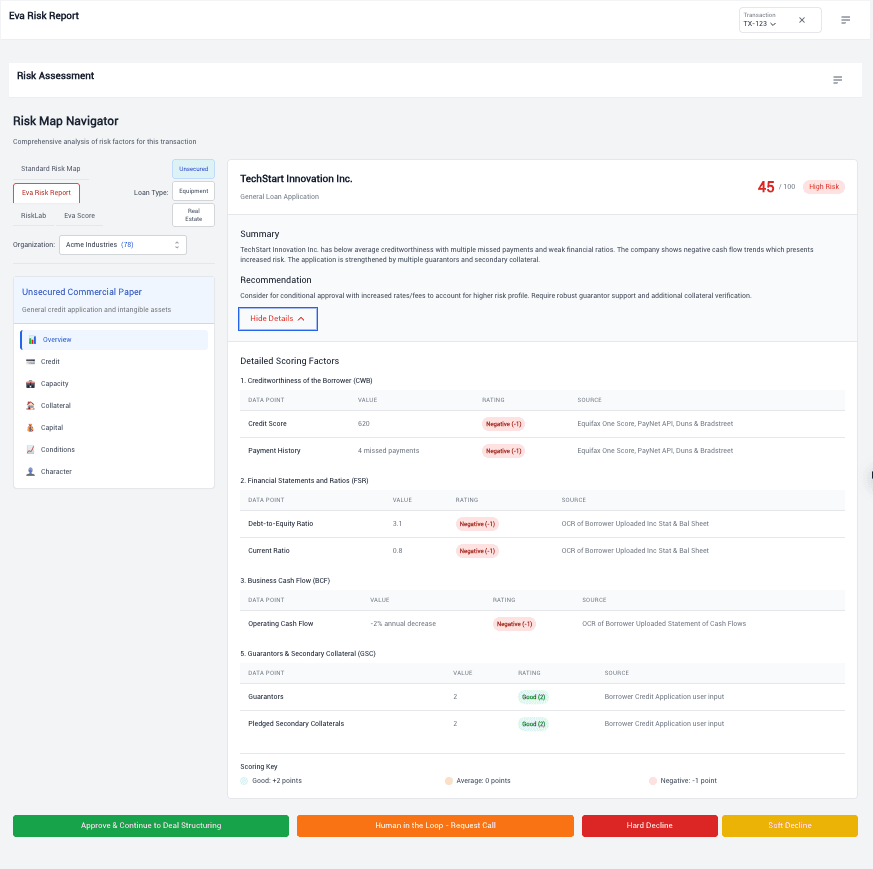

Advanced Risk Assessment

Intelligent credit risk evaluation, scenario modeling, and data-driven decision making

Comprehensive Risk Analysis

- Eva Risk Score & Report

Instantly generated, easy-to-understand risk score and summary for every application. - Credit Bureau Integration

Pulls business and FICO scores from 10+ sources for a complete picture. - Scenario Modeling

See "what-if" outcomes for your business before you decide. - AI Risk Advisor

Ask Eva anything about your risk profile or next steps—get instant answers.

Risk Assessment Flow

- Transaction data is loaded and initial risk metrics are calculated.

- Credit bureau data is retrieved and processed.

- Financial statements are analyzed for key ratios and trends.

- Industry benchmarks are applied for contextual comparison.

- The Eva AI model evaluates all data points and lets lenders choose custom weights for the response data in the form of the 5 Cs of creditworthiness.

- A final risk score and report is provided based on all data pulled in and analyzed.

What You Get

EVA Custom AI Agents

Create and customize specialized AI agents tailored to your specific business needs

Powerful Agent Customization

Format & Tone Control

Select from various response formats (Email, Formal Report, Term Sheet) and tones (Formal, Professional, Casual) to match your communication style.

Knowledge Integration

Connect your custom agents to specific knowledge bases and data sources for specialized expertise in credit analysis, risk assessment, or regulatory compliance.

Simple Creation Process

- Click "Create Custom AI" in the EVA Assistant

- Add an icon and name your agent

- Configure tone, format, and length preferences

- Specify data priorities and performance goals

- Start using your specialized AI assistant

Create Custom AI Agent

Credit Analysis Assistant

Analysis based on financial statements and industry benchmarks

Powered by Advanced AI

Built on NVIDIA Nemotron 70B (EVA), fine-tuned for financial services

Smart Matching

Intelligently matches borrowers with appropriate lending products based on financial profile and needs.

Data Orchestration

Automates collection, verification, and integration of financial data from multiple sources.

Document Intelligence

Extracts, analyzes, and verifies information from complex financial documents with high accuracy.

Credit Analysis

Performs sophisticated risk assessment and scoring using traditional and alternative data sources.

Lifecycle Assistant

Guides stakeholders through each step of the credit origination process with contextual assistance.

Transforming Credit Origination

Delivering real results for commercial lending: faster decisions, less fraud, and a seamless experience for all participants.

65–85%

Reduction in Processing Time

50%

Reduction in Fraud

How Eva Makes Lending Fun & Easy

Our AI assistant transforms the complex lending process into a delightful experience that saves time and reduces stress.

Smart Matchmaking

Eva screens your business application and plays matchmaker, finding your perfect lending partner faster than swiping right on a dating app!

Risk Analysis Magic

Eva taps into 10+ data sources to instantly create your risk profile, doing all the boring work while you focus on growing your business.

Customizable Experience

Adjust Eva's risk variables like you're customizing your avatar in a game – tweak settings, rerun reports, and find your perfect financial fit!

Meet Your Digital Lending Companion

Eva is more than just an AI—she's your friendly financial assistant who makes lending decisions simple, fast, and even a little bit fun!

- Tune Your Risk ProfileAdjust Eva's risk variables with simple sliders—like customizing your character in a video game, but for your business financing!

- Data Detective WorkEva gathers all your business data in seconds, saving you from the paperwork treasure hunt that traditional lenders require.

- Smooth OperatorFrom application to approval, Eva guides you through each step with a friendly interface that makes finance feel less… well, finance-y.

Ready to Meet Eva?

Say goodbye to lending headaches and hello to your friendly AI assistant. Book a quick demo to see how Eva can revolutionize your business financing experience!